August 2021

Logistics Update

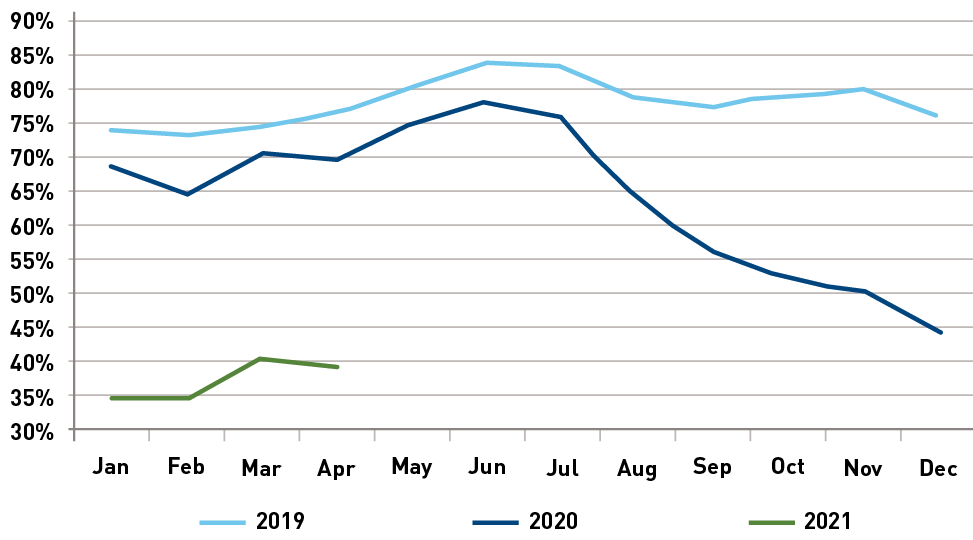

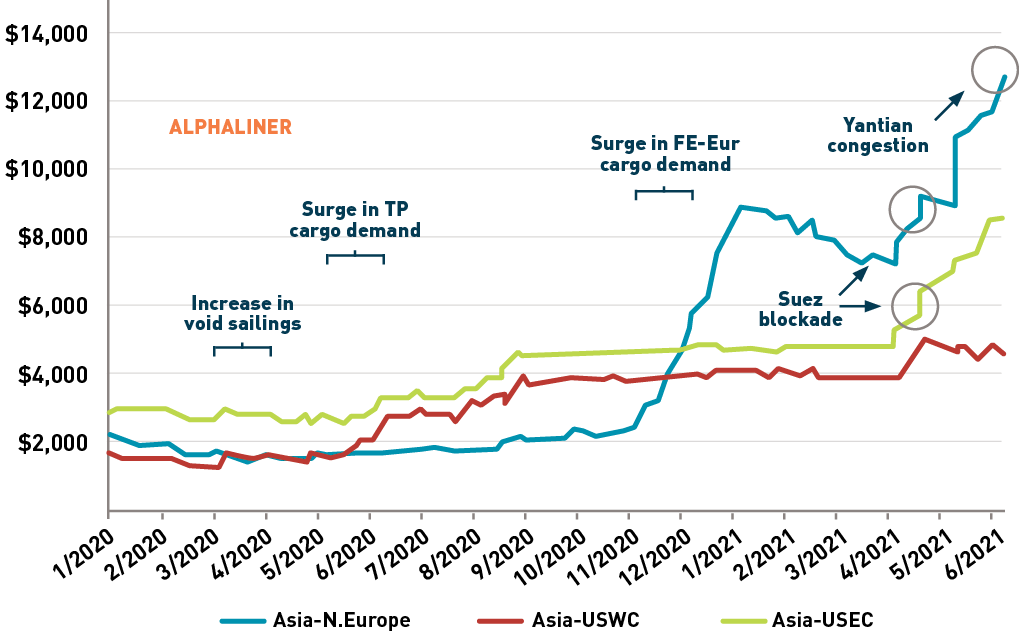

As importers vie to replenish depleted inventories and keep up with strong demand, industry experts predict international supply chain costs have not yet peaked. Ocean carrier service performance is at all time lows as well. Schedule reliability for ocean carriers is about 35% to 40% globally, according to Sea-Intelligence. Three-quarters of vessels that are late by 10 days. Industry analysts don’t expect demand to curtail or the industry dynamics to drastically change until late Q1 into mid-2022.

However, Savor Imports has implemented a number of tactics since April to offset shipping delays, some of the incremental expenses, and build safety stock inventories. The tactics are working. Savor received 29 containers in one week mid-August and had 69 more in transit at that time. We are expecting our service levels to rebound to more traditional numbers the next 30 days.

We will stand committed to communicating any temporarily out of stock situations to assist you inform your operator customers.

Global Schedule Reliability